Transforming the Life and Annuity Experience from Lead Through Servicing

The Zinnia Open›Insurer Experience enables insurers to innovate personalized products, accelerate speed-to-market, and enhance distribution support.

Harness the End-to-End Capabilities of the

Open>Insurer Experience

Origination

Accelerate origination with a 100% digital buying experience

– from needs analysis to quote and e-application – that can

be completed with or without advisor assistance.

Product Launch & Conversions

Innovate new products and accelerate speed-to-market

using leading-edge digital technology and end-to-end

administration services to keep pace with the demands of

today’s consumers and distributors.

System of Record

Transform how data is managed, analyzed, and

leveraged across the product lifecycle by creating a golden

source system of record. Streamline product and policy

creation, automate servicing, and simplify policy

management.

Distribution Management

Manage sales and distribution with tools that simplify

and streamline advisor onboarding, licensing,

appointments, and commissions.

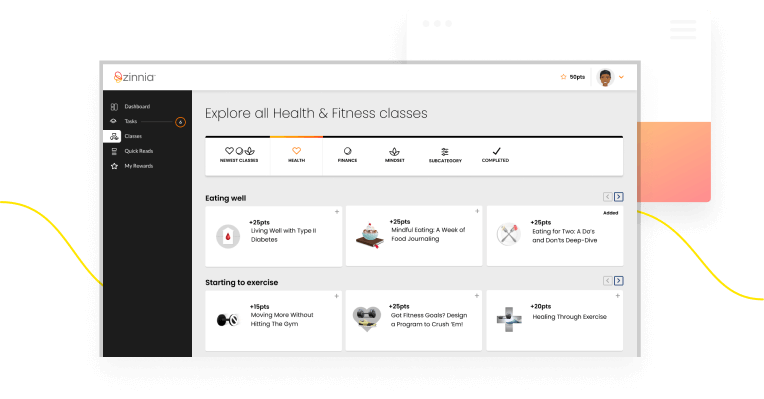

Engagement & Loyalty

Improve key metrics by capturing first-party data that

nurtures deeper, more meaningful relationships with

each customer.

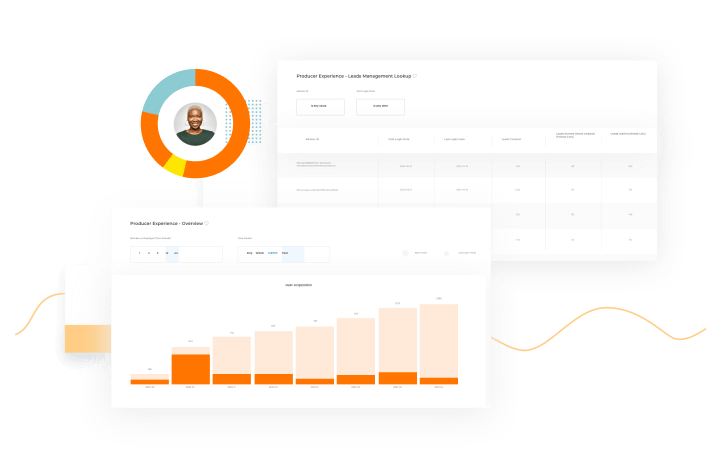

Data & Insights

Manage sales, distribution, and customer engagement

with real-time data, offering robust analytics and

business-building insights across the entire life

insurance and annuity product lifecycle.

Meet the Demands of Today

and Tomorrow

Zinnia Open Insurance helps carriers innovate, build, sell, and manage more insurance and annuity products to customers directly, via distributors, or a combination of both.

A digitally enabled experience, reaching customers at key moments with relevant product offerings and streamlined journeys, will become increasingly important.

Celent 2022 Tech Trends Previsory Report